Okay, so picture this: you’re juggling Bitcoin, Ethereum, and a handful of smaller coins, and you want to move between them without opening ten different apps. Sounds familiar, right? My first impression was simple—convenience. But after using a few wallets and watching trades clear (or stall) I realized there’s more at stake than just clicking «swap.»

Built-in exchanges in multicurrency wallets change the user flow. Instead of sending funds out to an exchange, converting, and sending back, you get everything in one interface. That saves time. It also reduces friction. But—seriously—it’s not all sunshine. There are trade-offs: liquidity, rates, custody models, and security practices all matter.

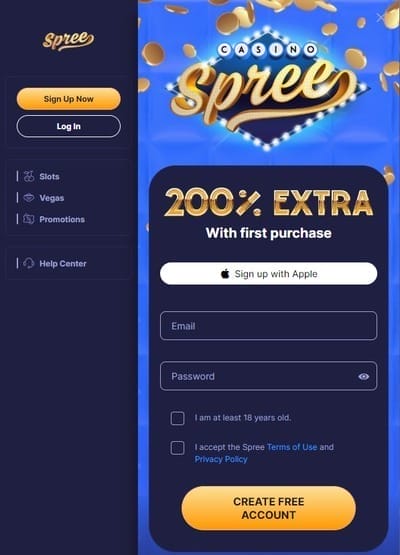

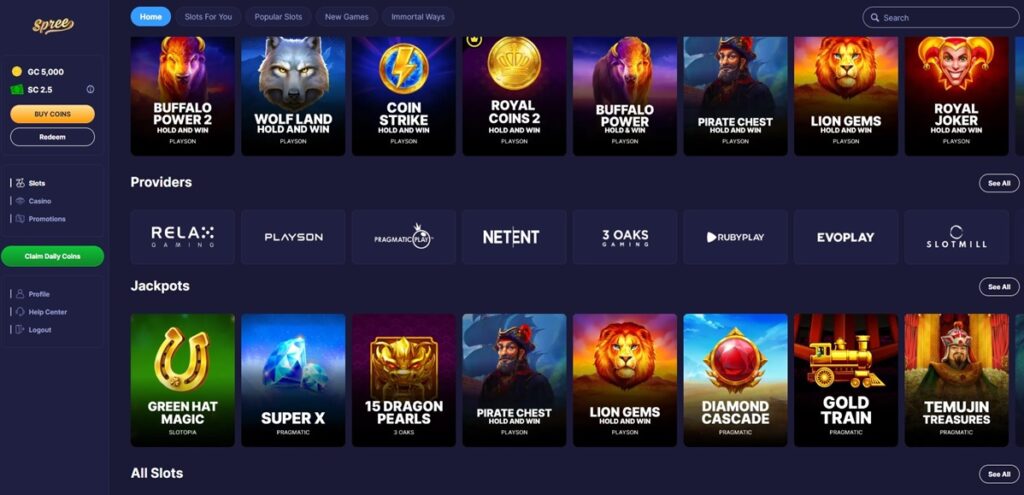

Let’s walk through what a good built-in exchange should do, where it often falls short, and how to think about your crypto portfolio when the wallet itself offers trading. If you’re evaluating options, check out atomic wallet as a case study for a multicurrency tool that bundles swap functionality right into the UI.

Why in-wallet swaps are tempting

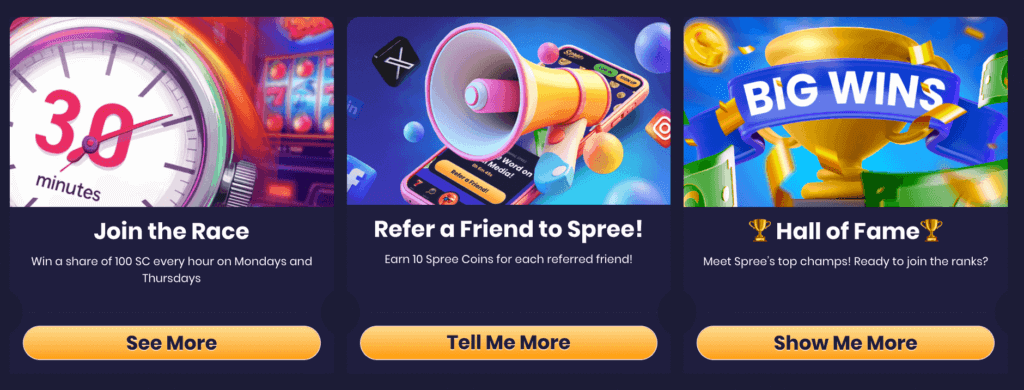

First off: convenience wins. Having a built-in exchange removes the context switching that causes errors—wrong addresses, wrong memos, fees piled on top of fees. You can rebalance a portfolio faster, take advantage of short-term opportunities, or convert a token to pay a gas fee without leaving the app.

Fewer steps means fewer mistakes. That’s especially helpful for newcomers who are still trying to remember which chain a token lives on. Also—I’ll be blunt—saving even a few minutes matters when gas spikes hit. The ability to do a swap instantly from your wallet can be the difference between a decent trade and a regret.

But there’s more than convenience. Some wallets aggregate liquidity from multiple sources, or use decentralized protocols under the hood, which can give surprisingly competitive rates. On the other hand, wallets that act as simple brokers sometimes add markups. So you need to be somewhat skeptical and check the effective rate, not just the displayed percentage.

Security and custody: the core trade-off

Here’s the thing. Custody matters. Non-custodial wallets keep your private keys locally, which is great, but it complicates in-wallet swaps that require interactions with smart contracts or third-party services. When a swap is initiated, the wallet often signs transactions that interact with external liquidity pools or swap aggregators. That’s perfectly normal, but it increases the attack surface.

On one hand, you retain custody of your keys. On the other hand, you’re trusting the swap path and the smart contracts involved. So I always look for transparency: can I inspect the transactions? Are fees and slippage clearly displayed? What’s the fallback if a trade fails mid-route? These details tell you whether the wallet is built by engineers who thought about edge cases or by marketers who prioritized glossy UX.

Also, be mindful of approvals. Approving token spend for swaps is routine, but leaving unlimited approvals everywhere is lazy and risky. Take the moment to limit allowances when possible. Yes—it’s extra clicks. Yes—it’s worth it.

Costs, liquidity, and slippage: the math you can’t skip

Okay, math time—brief and useful. When you do an in-wallet swap you should check three numbers: the quoted rate, the fee or spread, and the estimated slippage. Sometimes the wallet bundles a convenience fee into the rate. Other times the rate is pulled from a DEX aggregator and looks great until slippage eats the gains.

Pro tip: for large trades, break them up or test small amounts first. This is basic trading psychology and market mechanics. If the liquidity pool is shallow, even a $500 trade can move the price. My instinct told me that a big-looking rate was a deal once—then it slid as my swap hit the pool. Learn from my impatience.

Portfolio management: more than swaps

A built-in exchange helps rebalance, but portfolio health is broader. You want clear portfolio views, historical P&L, and sensible alerts for big moves. If your wallet includes integrated portfolio tracking across chains, that’s a huge plus. It reduces the need for separate tracking tools and gives you a holistic view when you’re deciding to swap.

Also consider tax and record-keeping. Wallet-level swaps can generate on-chain events that are easier to track than off-exchange conversions, but you still need to export trade history or connect a reliable accountant-friendly tool. Don’t skimp on this—reporting headaches later are worse than a few cents of fees now.

Privacy and regulatory considerations

Built-in exchanges vary in how much user data they collect. Some require KYC for larger amounts because they act as fiat bridges or custodial intermediaries. Others route trades via decentralized protocols without KYC. Decide what matters to you: privacy, ease of use, or regulatory-compliant rails for fiat conversions.

If you plan to move between fiat and crypto often, a wallet integrated with compliant on-ramps is convenient. If you prefer privacy, expect fewer fiat options and possibly higher friction. This is one of those trade-offs where there’s no right answer—only the one that fits your risk profile.

Practical checklist before trusting a wallet swap feature

Here are quick checkpoints I run through before using any in-wallet exchange:

- Are private keys non-custodial? (You control the seed phrase?)

- Is transaction transparency available? Can I see the contract calls?

- What are the fees/spreads vs. major DEXes or CEXes?

- What liquidity sources does the wallet use?

- Does the wallet limit approvals by default or request unlimited allowances?

- How easy is it to export trade history for taxes?

FAQ

Are built-in exchanges safe?

They can be. Safety depends on the wallet’s architecture, whether it preserves non-custodial keys, and the smart contracts or third parties used for swaps. Vet the claims, read recent audits if available, and start with small trades until you’re comfortable.

Will I always get the best rate inside a wallet?

Nope. Some wallets aggregate liquidity and offer competitive rates; others add markups. Always compare quoted rates to a trusted DEX aggregator or market price, especially for big trades.

How does this affect portfolio rebalancing?

It makes rebalancing faster and less error-prone, but you still need discipline. Track performance, mind the tax triggers, and avoid swapping impulsively during volatile spikes.